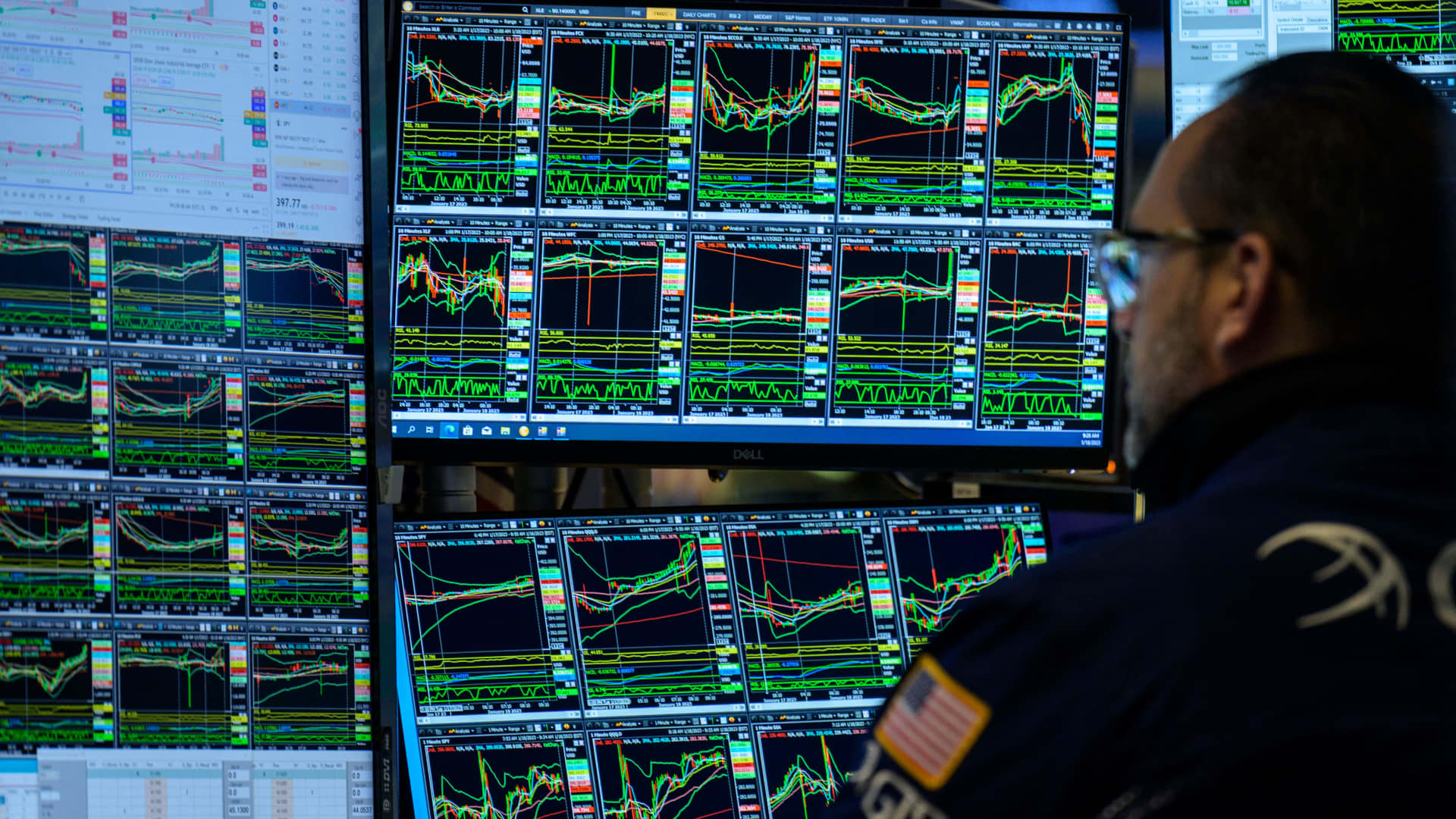

The Nasdaq Composite rose on Thursday The latest batch of corporate earnings And fourth-quarter GDP came in above expectations.

Stocks were mixed, with the tech-heavy index up 0.8%. The Dow Jones industrial average traded 60 points, or 0.2% higher, while the S&P 500 added 0.4%.

GDP Data released on Thursday showed the economy expanding at an annual rate 2.9% in the fourth quarter., the Commerce Department said. That’s higher than the Dow Jones estimate of 2.8%, but represents a slight cooling from the third quarter.

“With today’s better-than-expected GDP, investors think that when all is said and done, we can get out of a pretty smooth, mild recession that shouldn’t throw us into an even deeper bear market,” he said. Sam Stovall is Chief Investment Strategist at CFRA Research.

Meanwhile, the earnings season was strong Tesla’s results Given the Nasdaq Electric vehicle stocks boost. Tesla Up 8% since posting Recorded revenue and fixed revenue. Failed tech giants Microsoft, Apple, Amazon and Alphabet also traded slightly higher.

Airline earnings also emerged Southwest fell 5% more than expected Loss Its holiday was triggered by a meltdown. American Airlines Despite scoring in the fourth quarter, it fell. United and Delta also moved down.

Elsewhere, Chevron 3% added after declaration a A $75 billion share buyback plan.

All major averages point towards weekly and monthly gains. So far this week, the Dow and S&P are up 0.9% and 1.2%, respectively. The Nasdaq is up 1.9% this week and is on pace for its best month since July.

Attention now shifts to next week’s Federal Reserve policy meeting, where the central bank is widely expected to announce a 25 basis point hike as it battles high inflation. Investors will be looking for clues as to how much more the central bank wants to raise before cutting interest rates.